![]()

We traditionally provide docSAFE to the professions who demand top security and client confidentiality (among other things). However we are seeing docSAFE rise in popularity with other sectors, almost by accident but with very good reason.

You may have seen a mailer we sent out recently that illustrated how the NHS had suffered a huge breach of data of its junior doctors in the north-east. We researched this and found that the NHS staff use of WhatsApp is also widespread which is really worrying.

Organisations that hold any personal data, especially publicly accountable organisations, should be using systems to communicate that are extremely secure. docSAFE has been designed to be secure on a number of key levels – secure login (using 2-factor authentication), secure portal in which to exchange messages and documents, online signing, to be GDPR compliant, offer automatic backups to secure EU based servers and much more.

By using a portal instead of email, for example, the message sit in the cloud until the recipient accesses it. By return, the responses sit in the cloud until the sender accesses it. Both are notified and know the information is there – but it’s locked away safely, staying put, not flying through the ether.

We are expecting more uptake of docSAFE by schools, colleges, universities, doctors and hospitals and similar organisations where security simply cannot be the weak link. Talk to us if you think we can help with your secure communications.

Making Tax Digital (MTD) presents a significant change for British tax payers and is a massive undertaking for HMRC who has ambitious plans for its tax administration.

Making Tax Digital (MTD) presents a significant change for British tax payers and is a massive undertaking for HMRC who has ambitious plans for its tax administration. For any professional managing information on behalf of clients, email is dead. It is not secure and highly susceptible to human error. How many times have you sent information to or received information from the wrong source? I am regularly wrongly emailed client documents by a highly intelligent, trusted professional simply because I have a very similar name to his client. It is completely understandable but it could have any number of repercussions.

For any professional managing information on behalf of clients, email is dead. It is not secure and highly susceptible to human error. How many times have you sent information to or received information from the wrong source? I am regularly wrongly emailed client documents by a highly intelligent, trusted professional simply because I have a very similar name to his client. It is completely understandable but it could have any number of repercussions. We’ve all been there – passing round a document for feedback via several people. We lose track of the most up to date version and then someone comments late on an early iteration. It makes for confusing and long-winded communications at the very least. At worst, it can lead to much bigger problems if the wrong versions are acted on or published externally.

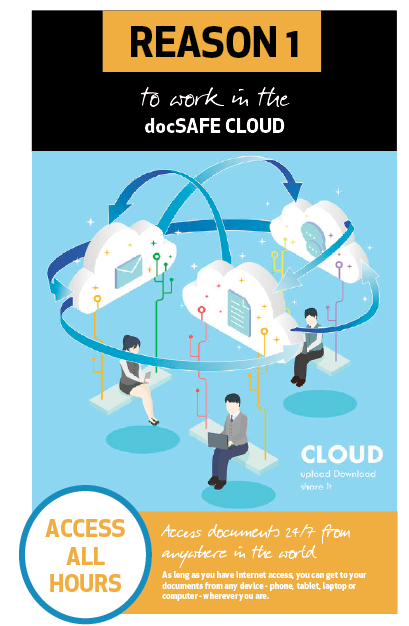

We’ve all been there – passing round a document for feedback via several people. We lose track of the most up to date version and then someone comments late on an early iteration. It makes for confusing and long-winded communications at the very least. At worst, it can lead to much bigger problems if the wrong versions are acted on or published externally. So why should you consider cloud working? We’ve written extensively on this but we’re going to keep it simple and give you five good reasons over the next few blogs on why you should be working in the cloud.

So why should you consider cloud working? We’ve written extensively on this but we’re going to keep it simple and give you five good reasons over the next few blogs on why you should be working in the cloud.